how much does cash app take out for instant deposit

Venmo also charges a 175 fee 025 Minimum and 25 maximum for instant cash-out transfers to your bank account. How does Cash App work.

7 Ways To Troubleshoot If Cash App Is Not Working

It uses an app-generated QR code to grant you cardless ATM access.

. Grab your cash from the ATM. But when looking for Cash App money hacks there are a few different ways you can get started. It stated out at 5.

When I work the Shipt app I average 25 an hour. Open your mobile banking app and locate a cardless ATM near you. How to withdraw money.

Keep in mind that Cash App to Cash App payments are instant and usually cant be canceled. Instant P2P transfers for Cash App to Cash App payments. Paper Check Requirements For Deposit with Cash App.

Deposits are free and typically arrive within 1-3 business days. One of the easiest ways to earn free money on Cash App is by using the popular Cash App 5 hack. You keep 100 of your tips but you will not tips in your bank account until after 24 hours have passed.

Some cash advances are free but others charge fees. Cash App is just one of many products that Square offers to help people with money transactions. Cash App is the easy way to send spend save and invest your money.

A real cash advance comes from banks credit card issuers or other reputable financial institutions like credit unions. Americans commonly turn to payday loans that end up leaving them further in debt. For just 199 mo plus a.

In order to deposit a check with Cash App some requirements must be met. The Gerald app has tools for budgeting bill tracking credit monitoring buy now pay later and much more. That Cash App borrow loan of 200 is a great option as an emergency fund.

Never pay full price for gas again. You can fill out everything online or through the app. To reiterate -- if something sounds too good to be true like free money in exchange for a small payment its likely a scam.

Creditors and banks usually limit how much you can withdraw via a cash advance. Drivers are charged 050 to get their money immediately. Instant to 1 business day.

Click here to download the Upside app. Either instant deposit which takes a small fee or the next day. Headquartered in San Francisco California Square launched in 2009 and provides payroll tools payment hardware and more for restaurants and other small businesses.

Using Instant Cashout does have a small fee associated with it. Cash App accepts regular bank deposits and instant deposits to your associated debit card. Get 5 In Free Cash App Money.

How much does a cash advance from an app cost. Sometimes money transfers take a few extra minutes depending on how quickly the shoppers back can process the payment. Employees of large employers.

When you need fast cash you can find better alternatives like Instacash SM which offers a fast secure and easy cash advance accessible through the MoneyLion app. A cash advance is a much better option. In-store cash and Cash-in-Transit insurance cash shrinkage deposit fees back-office and cash counting supervision costs quickly add up.

The check needs to be written to you. But this is a fun way to make a bit of extra money on the side without much effort. Choose the Mobile Cash Access option on the ATM.

Instacart shoppers get paid weekly but in 2019 Instacart also launched their Instant Cash Out feature. Instant Deposits are subject to a cost of 05 to 175 with a minimum fee of 025 and are credited to your debit card immediately. Theres a 199 processing fee for cash pickup at Walmart stores and instant deposit to cards other than the Payactiv card.

Use your phone to scan the QR code on the ATMs screen. To use Cash App you must first download the mobile app available for iOS 47 stars out of 5 and Android 46 stars out of 5. This means the check must be made out in your name and nobody elses.

You can keep money in Venmo or your bank account. Combined with the savings in the app youll save up to 62gal. Its Balance Shield Cash Out feature allows customers to use a portion of their upcoming paycheck to cover any potential overdrafts.

Instant transfers will cost you a minimum of 25 cents or 050 to 175 of the transfer amount whichever is greater. Save up to 62 per gallon. Use promo code RIDE35 in the Upside app for an extra 35gal signup bonus on your first fill-up.

Our software can also work to get your financial life in control. As the mobile check deposit service on Cash App is still new and is rolling out to only some of the customers theres really no way of telling what the limits are. With no monthly fee no interest and no credit check you.

This is still less interest than a typical payday loan and if you pay it back on time it doesnt cost much in interest fees. Cash app sends me a bonus. Cash App charges a fee for instant.

Instant Cashout is a great option for those who need quick access to their money. 42 stars out of 5. Gerald offers more than just instant cash.

They are listed below. How Does Cash App Work. The check needs to be payable in US Dollars.

For a retail store that trades 30 days a month employs a daily cash in transit service from Monday to Saturday and banks a monthly total of R2 million in cash these and other cash management costs could. There are reports of 5 deposits per month totaling 7500 or up to 3500 per check but thats unconfirmed. The Cash App Borrow feature has a flat fee of 5 for your loan unless you are late with your payments in which case that amount does increase.

Viewing your accessible balance and using Rx Discounts Financial Counseling and. Heres what you need to know. You can keep money in Venmo or.

Read our related article Why Your. You can even open up an FDIC-insured account with. I am now up to 15 per person that uses my.

There are two options for transferring money to your bank. Before you take out an advance make sure that your servicer is a well-established provider that offers low interest rates. Cash App Instant Transfer Fee.

Instacart shoppers are paid via direct deposit into your bank account. When you get money it goes into your Cash App balance which you can either keep there or transfer to the bank account you linked. And Cash App and Venmo both allow users to receive their paycheck up to two days.

Access to cash when you need it most. FloatMe does not support prepaid cards at this moment -- The best friend your bank never had. Enter to win a 300 Cash App deposit.

The app is simple to use swift and clean. -- FloatMe helps hard-working employees get ahead on their finances with overdraft alerts and access to emergency cash. Cash App will investigate and take necessary actions.

How To Use Cash App 2022 Youtube

Square S Cash App Details How To Use Its Direct Deposit Feature To Access Stimulus Funds Money Generator Free Cash App

Cash App Vs Venmo How They Compare Gobankingrates

How To Get Free Money On Cash App Gobankingrates

/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

How To Put Money On A Cash App Card

How To Add A Debit Card To The Cash App

How To Put Money On Cash App At Atm 2022 Cash App Atm Deposit Guide

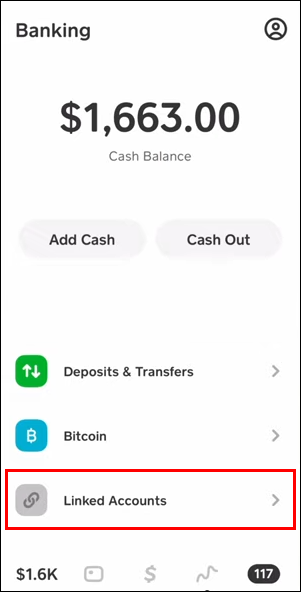

How To Add A Bank Account In The Cash App

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

How To Cash Out On Cash App And Transfer Money To Your Bank Account

How To Receive Money From Cash App Youtube

How To Cash Out On Cash App And Transfer Money To Your Bank Account

How To Receive Money From Cash App In 2 Different Ways

How To Cash Out On Cash App And Transfer Money To Your Bank Account

How To Cancel A Payment On Cash App Youtube

If You Receive A Suspicious Social Media Message Email Text Or Phone Call Regarding The Cash App Or See A Phone Number That You Be Cash Card Cash Supportive

Cash App Card Features And How To Get One Gobankingrates

How To Cash Out On Cash App And Transfer Money To Your Bank Account

How To Transfer Money From Your Cash App To Your Bank Account Gobankingrates